VR Bank Fulda is a cooperative financial institution rooted in the Fulda region since 1862. With a clear focus on innovative financial solutions and customer needs, the bank has established itself as one of the leading banks in the region. At the heart of its actions are its members, customers, and clients. VR Bank is more than just a bank—it serves as a lifelong partner, supporting customers both personally and digitally.

To reach the younger generation aged 18 to 30, the YoungFinance Team was established. Led by Lucia Bleuel, the team aims to connect with this target audience through modern communication channels.

Engaging and advising the younger audience proved challenging, as traditional communication channels such as emails, SMS, and phone calls did not meet the modern expectations and communication habits of this demographic.

In addition, there were significant concerns regarding data protection when using WhatsApp Business, as the security standards did not meet the requirements for the banking sector. Lucia and her new team faced the challenge of finding a solution that both complied with data protection regulations and aligned with the preferences and habits of the younger audience.

The Three Favorite Features of the YoungFinance Team

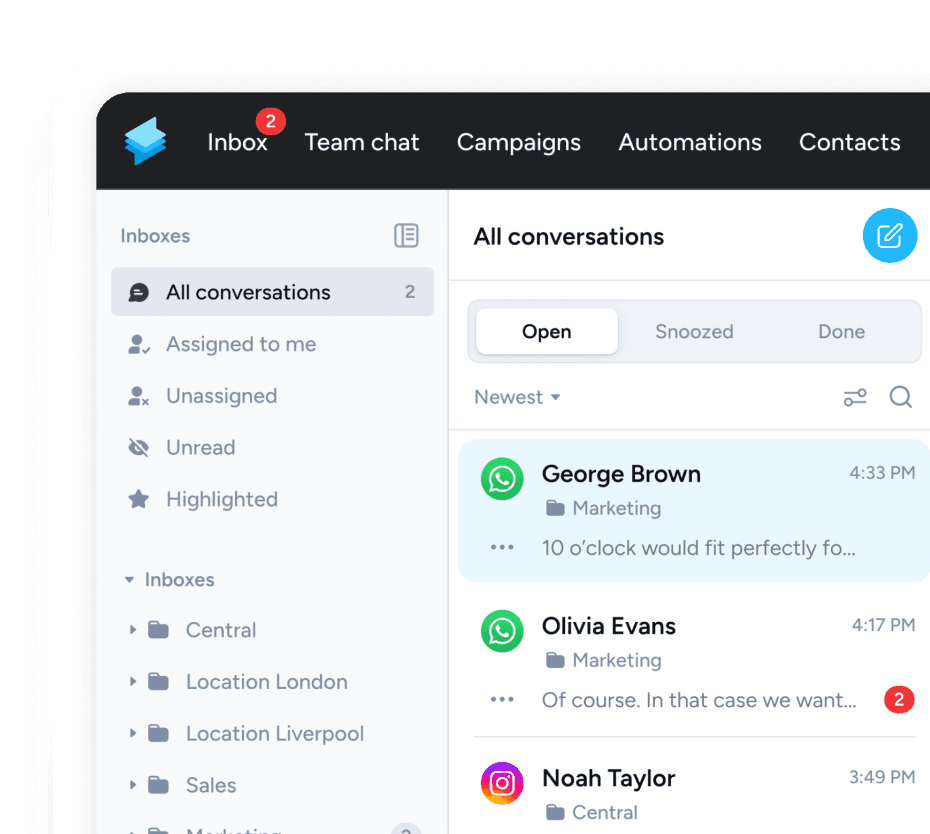

Lucia and her YoungFinance team particularly value the adaptability and user-friendliness of the Superchat platform. Communication has significantly improved thanks to features such as automated messages, personalized follow-ups, and detailed analytics. The team especially appreciates the ability to respond conveniently via the app and send automated birthday messages. These features are very well received by young customers and contribute to strengthening customer loyalty.

Lucia also highlights the inbox system, which allows messages to be assigned and marked as completed. This feature helps the team stay organized and ensures that only open messages remain visible. Another standout feature is the detailed analytics function, which enables the team to track the number of incoming messages and measure the success of their communication efforts.

Additionally, Lucia praises Superchat’s icebreaker feature. Icebreakers are simple conversation starters that enable quick and easy contact with customers."**

How VR Bank Fulda Benefits from Superchat

-

New Customer Groups: Superchat enabled the bank to reach new customers who previously would never have been contacted.

-

Quick Results: Within just half a year, VR Bank Fulda was able to reach 23.5% of its young customers via Superchat.

-

Optimized Communication: Superchat has significantly simplified the handling and management of customer inquiries. The inbox assignment features and the ability to mark chats as "completed" have made organization and teamwork incredibly efficient.

-

Stronger Customer Loyalty: Through automated and personalized messages, VR Bank Fulda was better able to address customer needs, resulting in a noticeable increase in interaction rates. The outcome is stronger customer loyalty.

-

Inquiry Management: Superchat offers comprehensive features for managing customer inquiries, making the processing of messages more efficient."

How VR Bank Fulda Uses Superchat

Selection and Implementation of Superchat

After extensive research and a series of evaluation meetings, the choice fell on Superchat. Superchat proved to be the ideal solution for VR Bank Fulda, as it was specifically developed for secure and data protection-compliant communication via WhatsApp and similar platforms.

The platform not only offers the necessary security but also a flexible and user-friendly solution that perfectly matches the needs of VR Bank Fulda. The YoungFinance team was not only impressed by the customization options of Superchat but also by the dedicated support team, which helped them implement their specific needs and requirements within the platform.

The implementation of Superchat was successful despite some challenges. The team first had to familiarize themselves with the features and capabilities of the platform, and adapting to the new communication processes and integrating them into existing workflows was particularly demanding.

With the comprehensive support of the Superchat team, as well as their technical and strategic advice, the team overcame this challenge with flying colors. Within just a few weeks, Superchat became a central tool in YoungFinance’s customer consulting, significantly increasing the efficiency and effectiveness of communication.

Kick-off, Strategy, and Daily Operations with Superchat

The successful launch of Superchat is attributed to a well-thought-out strategy. VR Bank Fulda introduced the platform with a targeted communication campaign that informed both existing customers and potential new clients about the benefits of this new communication channel. Through a combination of social media ads, targeted email and SMS campaigns, and personal invitations to consultations, the team was able to generate interest and curiosity within their target audience.

The clear communication of the benefits and the emphasis on data protection compliance helped build customer trust in the platform, leading to active usage.

Today, Superchat is an indispensable part of everyday operations at VR Bank Fulda. The YoungFinance team uses the platform daily to communicate directly with customers via WhatsApp. Instead of relying on emails, SMS, and phone calls, they can send fast, precise, and personalized messages, speeding up and simplifying the entire advisory process. Moreover, Superchat has become a key part of the weekly team meetings, during which current campaigns are discussed and new communication strategies are developed.

How VR Bank Fulda Plans to Scale Further with Superchat

The success achieved with Superchat has led VR Bank Fulda to plan an expansion of its use. The team is considering how to leverage additional features and communication channels in future campaigns to reach customers even more effectively. The introduction of a WhatsApp newsletter for new financial products and offers could be the next step to enhance advisory services and strengthen customer loyalty.

Additionally, VR Bank Fulda has developed a complete concept for other banks. This allows other institutions to get started with Superchat within just a few weeks. If you have any questions, feel free to contact our point of contact, Jennifer Herrlich (Phone: +49 151 12390896 or Email: Jennifer.Herrlich@vrbankfulda.de).