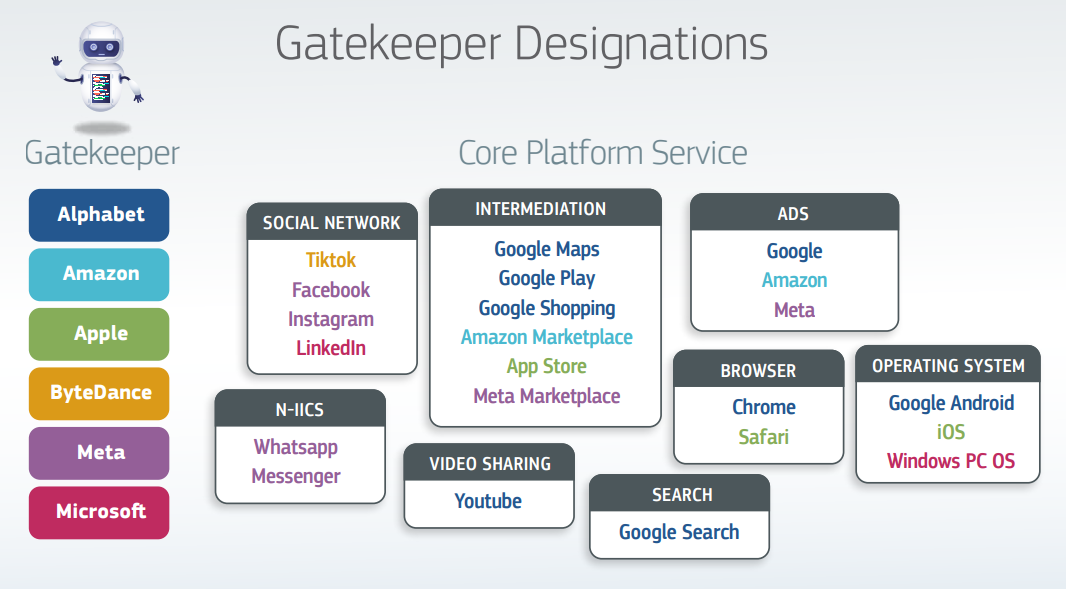

Regulation (EU) 2022/1925 of the European Parliament and of the Council, also known as the Digital Markets Act (DMA), came into force on 7 March 2024. The law was passed in 2022 with the aim of regulating large digital companies.

At the heart of the DMA is the definition and regulation of so-called "gatekeepers". The EU defines Gatekeepers as companies that operate core platform services that provide a gateway between businesses and consumers, which is so important to businesses that the Gatekeeper could abuse the position, similar to a monopoly, by prohibiting new market entry, effectively harming users.

Until now the European Commission named six Gatekeepers: Alphabet (Google), Amazon, Apple, ByteDance (TikTok), Microsoft and the company behind WhatsApp, Meta.

These Gatekeepers collectively operate 22 core platform services, that are now regulated by the DMA. In particular, this means opening up their platforms to other market players to ensure fair competition.

Other platforms such as iMessages, Gmail and the Bing search engine are under investigation (as of 11 April 2024). It is therefore possible that more gatekeepers or core platforms may be added in the future.

What is the Digital Markets Act?

The Digital Markets Act (DMA) is an EU regulation aimed at strengthening regulation of large digital companies, some of which have a dominant market position.

Due to network effects or their size, some companies are, at least in theory, able to abuse their market power to prevent fair competition, even if this does not constitute a monopoly according to current legal interpretations.

The Digital Market Act obliges the so-called gatekeepers to open their central platforms to other providers and prohibits them from favouring their own products and services on their platforms.

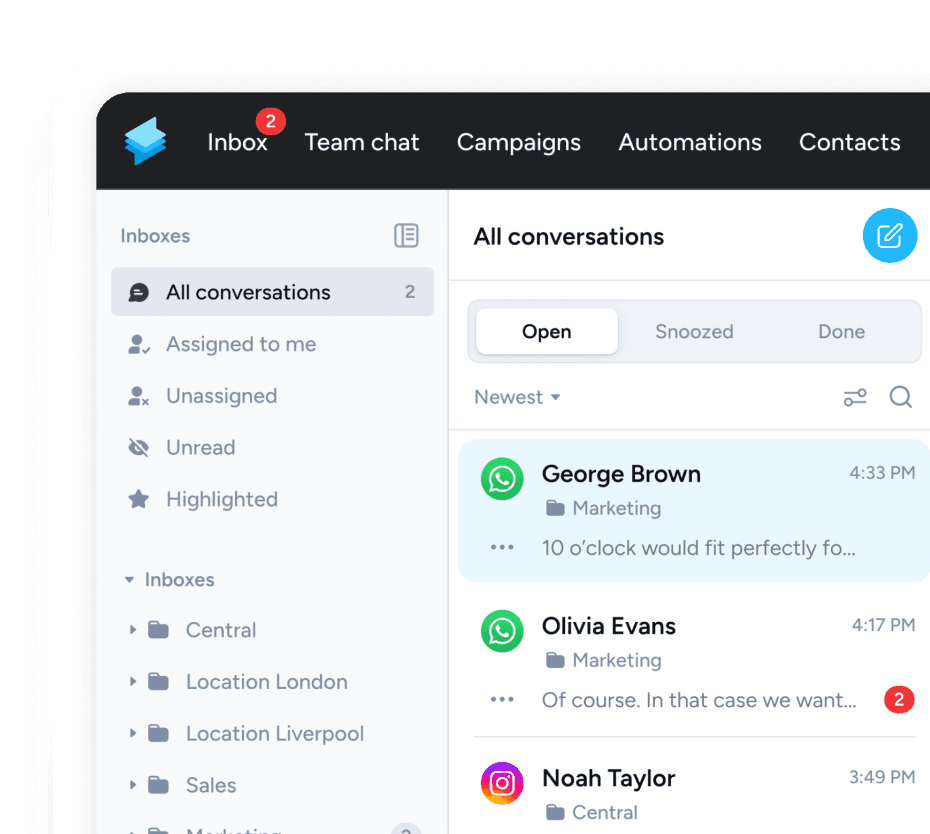

What is changing on WhatsApp?

The changes to WhatsApp and Facebook Messenger are some of the most direct end-user impacts of the DMA. Specifically, the EU is requiring Meta to open up its two messengers to third parties. This means that users will have to be able to receive and reply to messages from other messengers.

According to current information, there will be an opt-in feature in the apps. Users will have to enable the ability to receive messages from other messengers in WhatsApp or Facebook Messenger within the app, and will be able to reverse this setting at any time.

From the first screenshots, it looks like users will also be able to grant this permission to individual third-party apps, or even have to grant it on a per-app basis.

A video from the blog TheSpAndroid gives a glimpse of what the feature will look like:

What is changing for WhatsApp Business?

Nothing is expected to change for WhatsApp Business users for the time being. Meta has not yet announced any changes to the WhatsApp Business app and API as a result of the Digital Markets Act.

However, opening it up to other messengers could mean extending the reach of WhatsApp Business to other messengers. By opening up WhatsApp, it appears that direct messages from WhatsApp Business accounts, as well as WhatsApp newsletters, can also be sent to other messengers.

Of course, the same is true for third-party messengers. This means that competing products could emerge for the WhatsApp Business platform, forcing Meta to lower prices.

In the WhatsApp case, the European Commission is likely to focus on the development of WhatsApp Business and call prices.

Which messengers can communicate with WhatsApp?

It is not yet known which third-party applications users will be able to use to communicate with WhatsApp in the future.

The largest independent provider, Telegram, has not yet commented. Messenger apps Threema and Signal, which are particularly concerned about privacy, have already announced that they will not offer a connection to WhatsApp.

Potential interoperability with Facebook Messenger or Apple's iMessages will be of particular interest to WhatsApp Business users. Messenger is the second most used messaging app in the world after WhatsApp. By integrating their own messenger services, almost 90 % of internet users in the EU and the US could be reached by one of the two apps.

Integration with iMessages could also help Meta make WhatsApp more relevant to the US market. Although Facebook Messenger is the market leader there, WhatsApp is only in third place behind Apple's iMessages, with around 70 million users.

How does the integration work?

The [Process to achieve interoperability with WhatsApp or Messenger] (https://engineering.fb.com/2024/03/06/security/whatsapp-messenger-messaging-interoperability-eu/) was published by Meta on 6 March 2024, the day before the Digital Markets Act came into force.

The first step is for third parties to sign an agreement with WhatsApp and/or Facebook Messenger. Meta will then have three months to implement the integration.

According to Meta, the deadline refers to technical implementation, not end-user availability. This means that users may have to wait longer than three months before they can send and receive messages between applications.

The following features will be implemented in 2024:

- Send and receive text messages across platforms

- Sharing of pictures, voice messages, videos and other attachments

Features such as groups or live calls will be added later.

Technically, Meta uses the Signal protocol for end-to-end encryption for both messengers. Although the company recommends that third parties use the same protocol, integration with compatible protocols should also be possible, as long as they meet at least the same security standards.

Who benefits from the Digital Markets App's intervention in the messenger market?

The DMA is forcing Meta to open up its two messenger apps, WhatsApp and (Facebook) Messenger, to other providers. In the future, users will be able to communicate with users of the two messenger apps via other messengers.

For end users, this has the advantage that they can theoretically switch to their preferred messenger app without losing contacts or being limited in their ability to communicate.

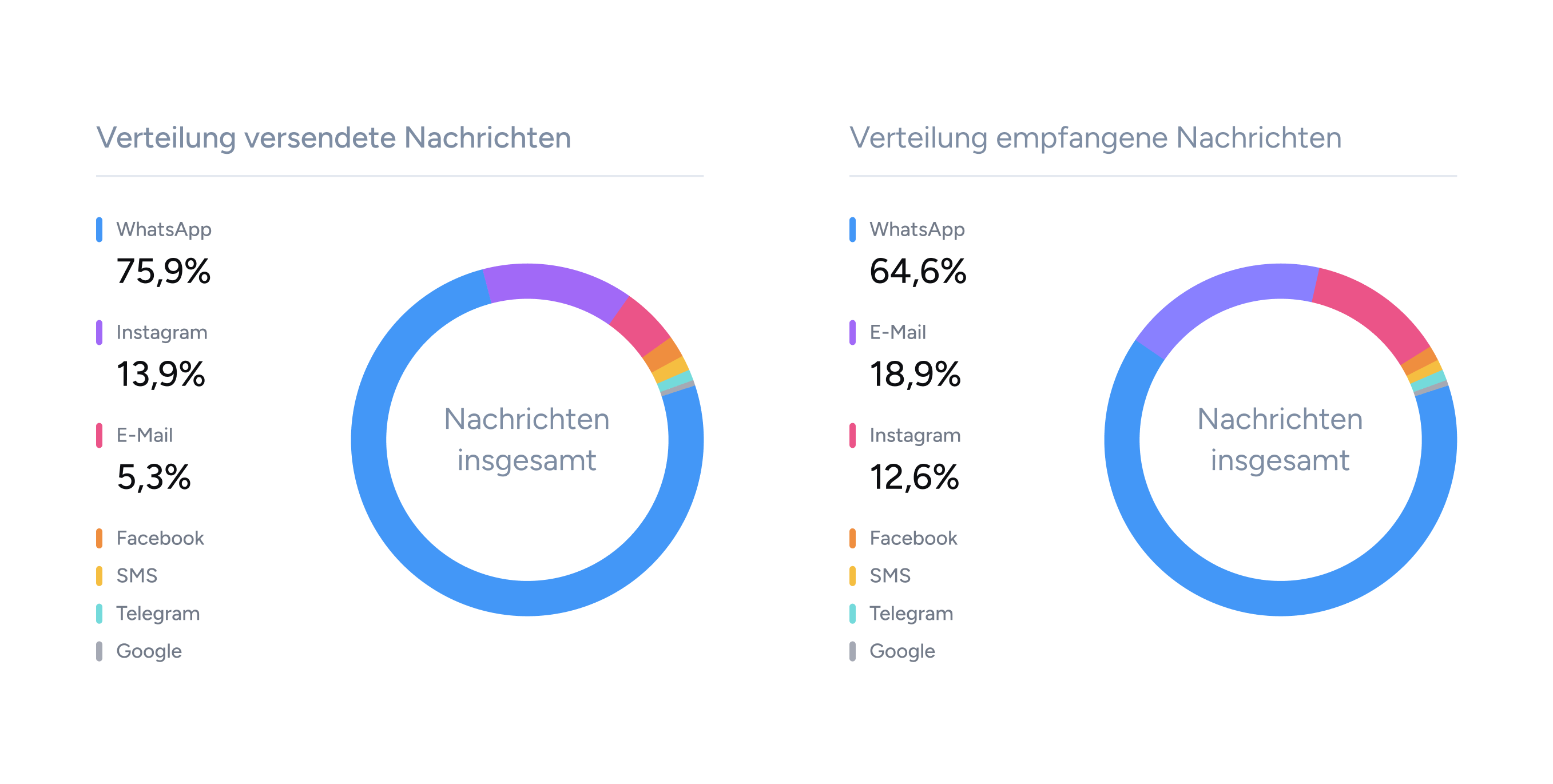

In practice, most users should see no change. On the one hand, because Meta has a market share of around 90% (often more) for messenger apps in the EU. On the other hand, the remaining messengers are not forced to integrate. Since Threema and Signal, two of the most popular WhatsApp alternatives, have already announced that they will not seek interoperability, it can be assumed that the majority of users will stay with WhatsApp.

Opening up the messenger means not only that WhatsApp messages can be received from other messengers, but also that those messengers can receive WhatsApp messages.

The EU Commission will most likely require Meta to open the platform to other APIs, i.e. to allow automated messages from businesses using other providers. However, it will still be a major hurdle for other messengers to convince WhatsApp users to opt in to receive messages from their service.

This means that only a fraction of users will choose to receive messages from other messengers. At the same time, almost all users of the connected messengers will be forced to receive messages from WhatsApp or to use WhatsApp as well.

As a result, the reach of businesses using the WhatsApp API is likely to increase or at least remain the same.

If the EU were to mandate interoperability between APIs and prohibit the currently planned opt-in process for cross-messenger messages, Meta would most likely have to lower the prices of conversations. In that case, it should be much cheaper for businesses to use.

In the short term, this would not necessarily be a disadvantage for Meta, as it would likely accelerate the adoption of messengers as a means for businesses to reach customers.

What are the risks for users?

The negative effects of opening up are mainly related to two issues: privacy concerns and the potential abuse of the integration for spam or fraud.

In terms of privacy, nothing should change for users, as Meta currently only makes the Messenger interface available to users of the same or a compatible protocol. In particular, this means that all messages must be encrypted end-to-end and cannot be read by Meta or the other messenger provider.

The risk of spam is also likely to be limited with the current implementation. While there are likely to be providers who will try to attract users and businesses with less stringent policies, WhatsApp is likely to try to enforce its own policies for inter-messenger communications.

In addition, the current implementation allows users to reject messages from other messengers at any time.

Conclusion

The DMA forces Meta to open its messenger applications to other messengers. This is fundamentally positive, as it reduces network effects and makes it easier for users to choose an alternative provider. As two popular alternatives, Threema and Signal, have already refused to integrate, this effect is clearly mitigated.

However, it could result in WhatsApp having even greater reach. The business model that Meta is pursuing with WhatsApp is likely to be strengthened by interoperability.

For users of the WhatsApp Business API, little is likely to change. However, if the EU increases pressure to integrate alternative APIs, this could significantly reduce costs for businesses and rapidly accelerate the spread of messengers for marketing purposes.